Certificate of Insurance

A certificate of insurance can be a frustrating need as a business owner. Do you need a law degree to complete certificates of insurance? It sure feels like it for our staff sometimes. First, they are more complicated and our insureds customers are more demanding. This is because of added language and increased limits our insured’s customers require.

Why do you need a certificate of insurance

First, certificates of insurance are something you see required by contract but not something many people typically talk about. Below, we’ll detail what a certificate of insurance is, why you need one, when to ask for one and what one typically entails.

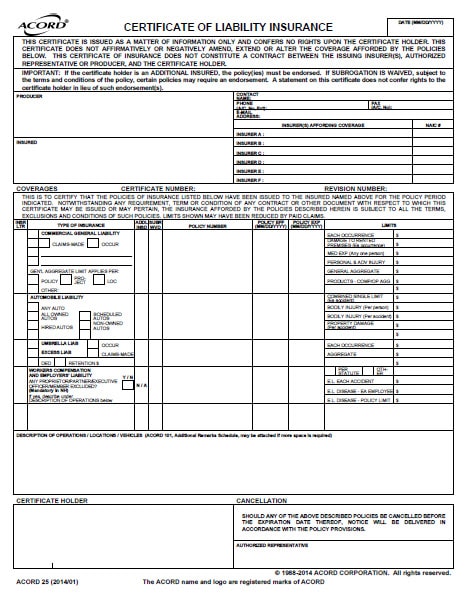

Next, certificates of insurance are documents from an insurance company demonstrating you have a current business insurance policy.

Why do I need to provide certificates of insurance? First, certificates of insurance shows proof that you have insurance. Some businesses or customers may request to see this proof before they consider working with you. Also, some may have that as a requirement or condition of doing business with them. Also, insurance protects your business from risks and can protect your clients and customers, too.

Why should you ask for a certificates of insurance?

Any informed client will ask their contractor or other business they work with for a certificate of insurance to make sure the right insurance with the necessary limits is in place for the work.

What should typical certificates of insurance include? A typical certificate of insurance should identify the person who has the policy (the “insured”), the mailing address, type of policy, policy limits, insurance company contact information, and additional insured, if there are any. Double-check the certificate matches the name of the company or person you’re working with, has the correct coverage (which will not expire before the work is completed), lists coverage amounts and is issued by an actual insurance company.