Surety Insurance

If you need surety insurance to provide your service or products, you should look into our surety bonds. This is important for business owners.

A surety bond is a type of insurance. It is used when you get something from someone and they don’t do what they say. The insurance company pays the person back. Professional Insurance Strategies is a company that can help you get bonded quickly. They have an online system for getting a quote.

Surety Bond Definition

The surety insurance company guarantees that the person with the obligation will do it. If they don’t, then the surety company pays. A surety company is a business where people go to get bonded.

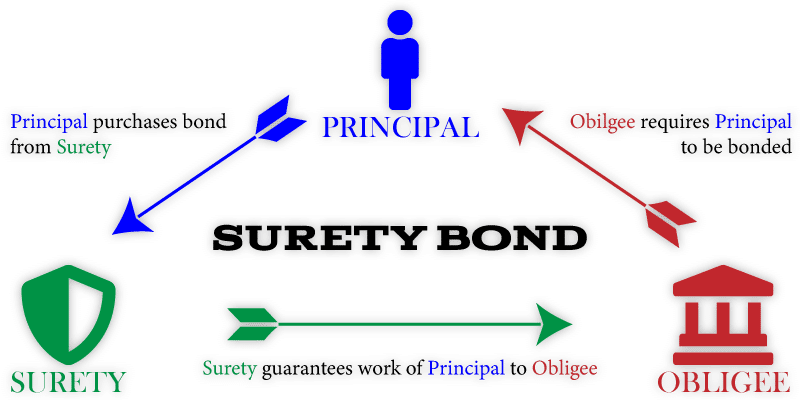

A surety bond is a three-party instrument between you, an insurance company, and the contractor. It helps ensure that the contractor will do what they are supposed to. It’s called a “bond” because it’s been used this way for centuries.

In surety insurance, you pay money to a company. If something bad happens to you, they will help. In surety, there is a contract between two people. If something bad happens, one person promises to do something for the other person. Insurance is based on statistics and probabilities of an accident happening. Surety is mostly about contracts between two people.

Contractors Bond

If someone needs a contractor’s bond, tell them you do not provide this service directly. You can help them find a qualified Surety Agent or Contract Bond Company in the area. If they don’t know any, you could look up companies on the internet.

Public building contractors have to pay people. If they don’t, the people will be mad. In most cases, payments are determined by the final completion of a job. In some cases, payment is guaranteed by putting up a bond. Public building bonds do not require surety, but they are payable to the government agency that gave you the contract. Bonds also guarantee good and faithful performance of every contract obligation with the bond itself being part of the contract between you and your contractor.

We need to be careful because if we’re not, then we might get in trouble. If you don’t pay your contractors for the work that they do, then the company will charge you more money. It is important to keep track of when payments are due and make sure that you send them in on time after the work has been completed. A payment bond is a type of bond that helps with paying for special assessments where people have paid taxes on their property for an improvement project.

Types of Surety Bonds

A surety bond is a type of insurance that is paid for by someone else to protect you from what the person should have done. If they don’t, then the insurance company will pay for it instead. A Surety & Casualty Insurance Company is a company that can help you get bonded quickly if you want to use this system. They have an online system for getting a quote. The surety company guarantees that the person with the obligation will do it, or they are responsible instead of you having to pay yourself. A surety company helps people get bonded. It is a 3-way agreement between you, an insurance company and the person who wants to bond you. If you do not pay then the insurance company pays it.

A surety bond is like an insurance bond. You promise to do something for someone if they don’t pay the other person on time, but it is more formal. A surety company will take care of it instead of you. The agreement has a fund that will help cover the loss or damage, but it does not cover against risk of loss or damage like an insurance bond would.

People might need money for their work. They can get it from a surety bond. If you need money, you can ask a Surety for a bond and they will give it to you. If someone is not paying their workers, the contractor has to pay the worker themselves. The contractor pays with a surety bond because there is insurance against them not paying the worker themselves if they have one.

Who are the parties to a bond?

When someone does not do what they say that they will, then another person pays for it instead. A surety bond is a three-way contract between you, the other person, and an insurance company to make sure that the other person does what he says. It means that if something bad happens the insurance company pays for it instead of you.

The person doesn’t do what he says, but the insurance company pays for him. A surety bond is a three-way contract between you, the insurance company, and the person who needs to be bonded. It means that if something bad happens, then he will do what he said in order to get paid by the insurance company. Surety bonds are different than just “insurance bonds.” They cover against losses or damage while an insurance bond guarantees performance on a promise.

Other types of insurance: